W2 tax calculator

How is W2 income calculated. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

The easiest way to understand the progressive tax system is to think of income in terms of buckets.

. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. W-2 Wages Unadjusted Basis. IRS tax forms.

You have nonresident alien status. This tax calculator is solely an estimation tool and should only be used to estimate your tax liability. Monthly Healthcare Contribution month.

Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. This Tax Return and Refund Estimator is currently based on 2022 tax tables. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Plug in the amount of money youd like to take home. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens.

Ad Try Our Free And Simple Tax Refund Calculator. 1099 vs W2 Income Breakeven Calculator. 100 Accurate Calculations Guaranteed.

File Online Print - 100 Free. Ad Use Our W-2 Calculator To Fill Out Form. For the tax calculators below be sure to have your 1099 or W-2 form handy and be ready to answer a few basic questions about your filing status income.

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net. Get W-2 early access and start your tax filing early. The first bucket of income is taxed at 10 the second at 12 the third at 22 and so.

Net W2 Earnings - - Expected Independent Bill Rate hour. Show assumptions Calculate Breakeven. Prepare and e-File your.

2 File Online Print - 100 Free. Ad 1 Use Our W-2 Calculator To Fill Out Form. Send an electronic copy of your early W-2 forms to an HR Block office and start the tax preparation.

Calculate your adjusted gross income from self-employment for the year. Calculate your Total W-2 Earnings. Estimate your tax withholding with the new Form W-4P.

Estimate your paycheck withholding with our free W-4 Withholding Calculator. How Income Taxes Are Calculated First we. Here is how to calculate your quarterly taxes.

Use the IRSs Form 1040-ES as a worksheet to determine your. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand. It will be updated with 2023 tax year data as soon the data is available from the IRS.

After all those steps above you may subtract the total taxes from your gross income from the number you got from your pretax deductions and your other. Ad Use Our W-2 Calculator To Fill Out Form. File Online Print - 100 Free.

To arrive at your total salary using Box 1 add your federal taxable wages shown in that box to your nontaxable wages plus your pretax deductions that are. The calculator below will help you compare the most relevant parts of W2 vs 1099 by looking at how the two options affect your income and tax situation but its important to note that this is. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. How to calculate your tax refund. W-2 Early Access Calculator.

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Solved W2 Box 1 Not Calculating Correctly

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

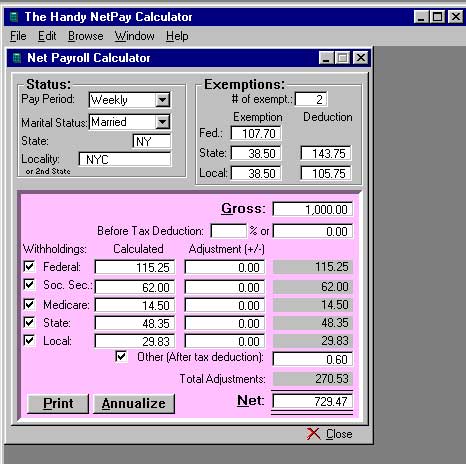

W 2 1099 Filer Software Net Pr Calculator

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

How To Calculate 2019 Federal Income Withhold Manually

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Ambertax Usa Tax Refund For J 1 H 2b And Other Temporary Visitors

Income Tax Calculator Estimate Your Refund In Seconds For Free

Paycheck Calculator Online For Per Pay Period Create W 4

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

How To Determine Your Total Income Tax Withholding Tax Rates Org

2021 Tax Calculator Frugal Professor

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Calculation Of Federal Employment Taxes Payroll Services

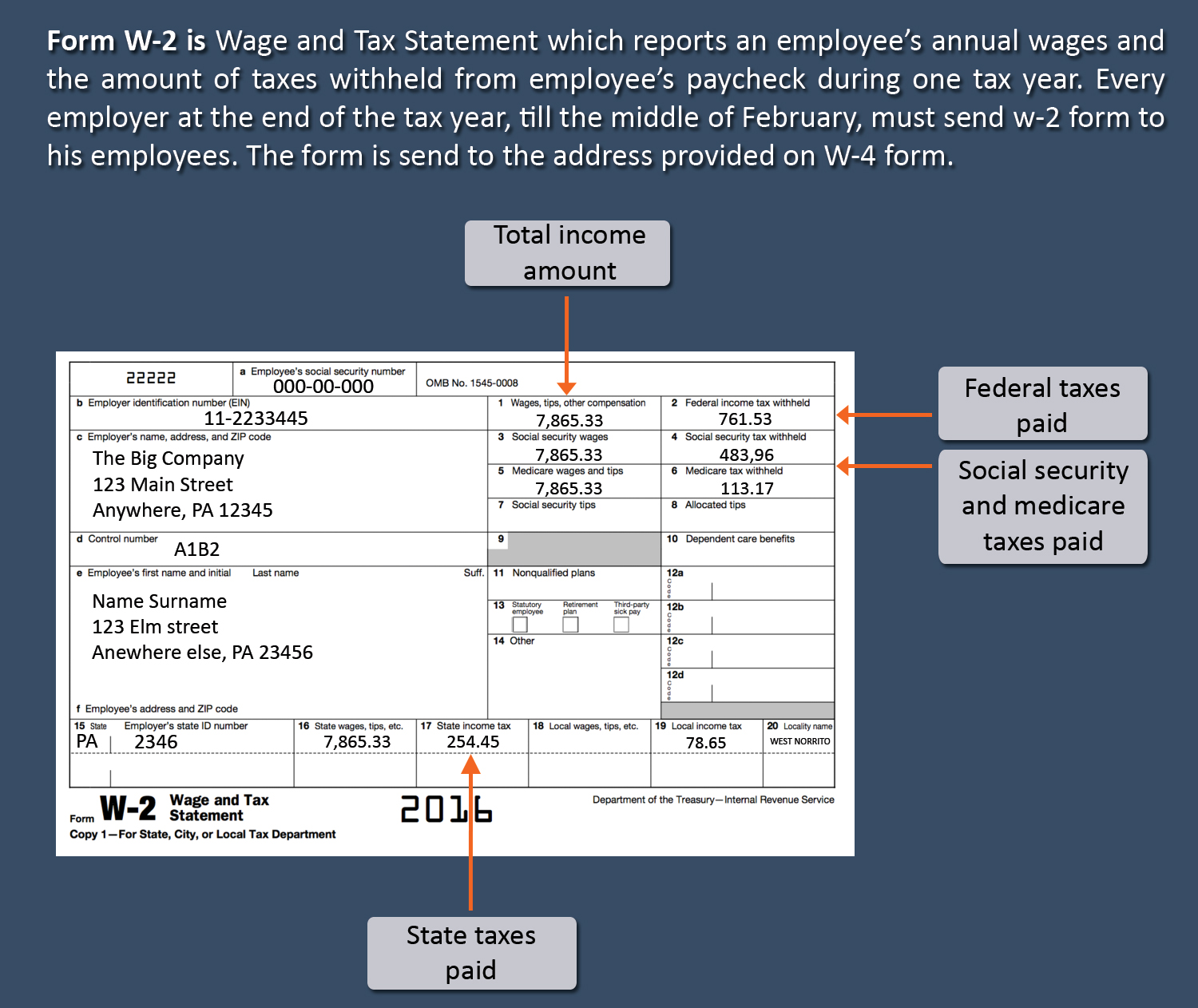

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Instant W2 Form Generator Create W2 Easily Form Pros